Tuesday, March 31, 2009

slap chop!

like every blog in the blog-o-sphere, it was reported that the dude from the sham-wow commercials got pinched in miami for beating up a hooker.

this started it all...

Monday, March 30, 2009

NEW HAMPSHIRE HEADLINES!

Man accused of lying on floor to peek at woman

NASHUA, N.H. – A Massachusetts man has been arrested on charges he peeked at a woman dressing in a Nashua, N.H., store. Police told WMUR on Friday that the man was charged with lying on the floor and looking into a fitting room at Kohls. Police said the woman did not see him, but her mother spotted a man lying on the floor looking into the changing room.

Police said the man was arrested in Natick, Mass., in January on similar charges. He told police has been in the United States for about two years and is from Guatemala.

--------------------------------

Cops: Man finds cell phone and demands $300 for it

SALEM, N.H. – Police arrested a school safety officer, saying he demanded $300 from a woman after finding her cell phone. The 30-year-old man, who works at Lawrence High School in Massachusetts, was charged with theft of lost mislaid property Saturday.

Police said the woman lost the phone at a Wal-Mart. The man found it and first told her she'd have to pay him $200 if she wanted it back. Police said he later upped the price to $300.

The woman called police, who set up a sting operation. The man was arrested after he met the woman at a race track parking lot. She gave the man an envelope containing $21.

After he was arrested, the man told police he was embarrassed and had made a mistake. He faces arraignment in Salem District Court next month.

----------------------------------

Man accused of urinating on Conn. casino worker

MASHANTUCKET, Conn. – Police said a New Hampshire man was arrested early Monday after allegedly urinating on an employee at the MGM Grand Casino at Foxwoods. Police said the man, 39, began urinating inside a concourse trash can and then on a casino employee.

Police charged the man with breach of peace. They said he was intoxicated and was arrested without incident.

The man was scheduled to appear April 14 in New London Superior Court.

------------------------------

too bad the old man on the mountain wasn't still with us today so he could thumb his nose at these guttersnipes...

NASHUA, N.H. – A Massachusetts man has been arrested on charges he peeked at a woman dressing in a Nashua, N.H., store. Police told WMUR on Friday that the man was charged with lying on the floor and looking into a fitting room at Kohls. Police said the woman did not see him, but her mother spotted a man lying on the floor looking into the changing room.

Police said the man was arrested in Natick, Mass., in January on similar charges. He told police has been in the United States for about two years and is from Guatemala.

--------------------------------

Cops: Man finds cell phone and demands $300 for it

SALEM, N.H. – Police arrested a school safety officer, saying he demanded $300 from a woman after finding her cell phone. The 30-year-old man, who works at Lawrence High School in Massachusetts, was charged with theft of lost mislaid property Saturday.

Police said the woman lost the phone at a Wal-Mart. The man found it and first told her she'd have to pay him $200 if she wanted it back. Police said he later upped the price to $300.

The woman called police, who set up a sting operation. The man was arrested after he met the woman at a race track parking lot. She gave the man an envelope containing $21.

After he was arrested, the man told police he was embarrassed and had made a mistake. He faces arraignment in Salem District Court next month.

----------------------------------

Man accused of urinating on Conn. casino worker

MASHANTUCKET, Conn. – Police said a New Hampshire man was arrested early Monday after allegedly urinating on an employee at the MGM Grand Casino at Foxwoods. Police said the man, 39, began urinating inside a concourse trash can and then on a casino employee.

Police charged the man with breach of peace. They said he was intoxicated and was arrested without incident.

The man was scheduled to appear April 14 in New London Superior Court.

------------------------------

too bad the old man on the mountain wasn't still with us today so he could thumb his nose at these guttersnipes...

The Dead on The View

Obviously "The Dead" have always been a nostalgia act by definition, but Bobby and Warren playing a Jerry tune under the GD name, on day time TV with Whoopsi still seems pathetic. Oh, and they never let Phil sing for a reason.

All Points West Lineup

Friday, July 31: Beastie Boys, Yeah Yeah Yeahs, Vampire Weekend, The National, Fleet Foxes, MSTRKRFT, Q-Tip, The Pharcyde, Organized Konfusion, The Knux, Ra Ra Riot, Seasick Steve, Telepathe, Shearwater, Heartless Bastards, Flying Lotus, College Humor Live, Arj Barker, Eugene Mirman and Bo Burnham.

Saturday, August 1: Tool, My Bloody Valentine, Gogol Bordello, Arctic Monkeys, Neko Case, The Ting Tings, Yelle, Crystal Castles, St. Vincent, Tokyo Police Club, The Cool Kids, Kool Keith, Cage the Elephant, Chairlift, White Rabbits, Electric Touch, The Postelles, Black Gold, College Humor Live, Tim & Eric, Judah Friedlander and Jim Jeffries.

Sunday, August 2: Coldplay, Echo & The Bunnymen, MGMT, The Black Keys, Elbow, Silversun Pickups, Mogwai, We Are Scientists, Ghostland Observatory, The Gaslight Anthem, Etienne De Crecy, Lykke Li, Akron/Family, Steel Train, Kitty, Daisy & Lewis, College Humor Live, Janeane Garofalo, Michael Showalter and Todd Barry.

Tickets go on sale April 3. Single day tickets are $89, while three-day passes start at $199.

----------------------------------------------------------------------------------

Friday looks good

Saturday, August 1: Tool, My Bloody Valentine, Gogol Bordello, Arctic Monkeys, Neko Case, The Ting Tings, Yelle, Crystal Castles, St. Vincent, Tokyo Police Club, The Cool Kids, Kool Keith, Cage the Elephant, Chairlift, White Rabbits, Electric Touch, The Postelles, Black Gold, College Humor Live, Tim & Eric, Judah Friedlander and Jim Jeffries.

Sunday, August 2: Coldplay, Echo & The Bunnymen, MGMT, The Black Keys, Elbow, Silversun Pickups, Mogwai, We Are Scientists, Ghostland Observatory, The Gaslight Anthem, Etienne De Crecy, Lykke Li, Akron/Family, Steel Train, Kitty, Daisy & Lewis, College Humor Live, Janeane Garofalo, Michael Showalter and Todd Barry.

Tickets go on sale April 3. Single day tickets are $89, while three-day passes start at $199.

----------------------------------------------------------------------------------

Friday looks good

Sunday, March 29, 2009

Friday, March 27, 2009

you make the call pt. 300!

Tuesday, March 24, 2009

I wish I had an Evil Twin

Saved by their indistinguishable DNA, identical twins suspected in a massive jewelry heist have been set free. Neither could be exclusively linked to the DNA evidence. German police say at least one of the identical twin brothers Hassan and Abbas O. may have perpetrated a recent multimillion euro jewelry heist in Berlin. But because of their indistinguishable DNA, neither can be individually linked to the crime. Both were set free on Wednesday. In the early morning hours of February 25, three masked men broke into Germany's famous luxury department store Kaufhaus Des Westens (KaDeWe). Video cameras show how they climbed into the store's grand main hall, broke open cabinets and display cases and made off with an estimated €5 million worth of jewelry and watches.

When police found traces of DNA on a glove left at the scene of the crime, it seemed that the criminals responsible for Germany's most spectacular heist in years would be caught. But the DNA led to not one but two suspects -- 27-year-old identical, or monozygotic, twins with near-identical DNA. German law stipulates that each criminal must be individually proven guilty. The problem in the case of the O. brothers is that their twin DNA is so similar that neither can be exclusively linked to the evidence using current methods of DNA analysis. So even though both have criminal records and may have committed the heist together, Hassan and Abbas O. have been set free.

LINK

pee-pee

Monday, March 23, 2009

Antique House For Rent - Newmarket

Antique house, 4 large bedrooms, eat in kitchen, pantry, full bath with tub, living room and porch. 5 min. to UNH bus stop, 4 miles to UNH campus. Large yard with river frontage for swimming and boating. Ample off street parking. Newly painted with updated appliances. Available June, 2009. One year lease, 4 occupants. Utilities and heat not included. Security deposit required. No pets.

Antique house, 4 large bedrooms, eat in kitchen, pantry, full bath with tub, living room and porch. 5 min. to UNH bus stop, 4 miles to UNH campus. Large yard with river frontage for swimming and boating. Ample off street parking. Newly painted with updated appliances. Available June, 2009. One year lease, 4 occupants. Utilities and heat not included. Security deposit required. No pets.LINK

Looks pretty classy guys, might have to make a phone call and check this place out.

Sunday, March 22, 2009

Songsmith gets political

I'm assuming this is a response to this Paul Krugman blog entry. Politics aside, this kid is simply a tool.

Saturday, March 21, 2009

What's Your Walk Score?

Walk Score helps people find walkable places to live. Walk Score calculates the walkability of an address by locating nearby stores, restaurants, schools, parks, etc. Walk Score measures how easy it is to live a car-lite lifestyle—not how pretty the area is for walking.

Toast House: 57 out of 100 — Somewhat Walkable

Old Central St Apartment, Newmarket: 69 out of 100 — Somewhat Walkable

My Montreal Apartment: 88 out of 100 — Very Walkable

Parents' House, Newbury NH: 12 out of 100 — Car-Dependent

Most walkable cities:

1. San Francisco

2. New York City

3. Boston

4. Chicago

WalkScore

Toast House: 57 out of 100 — Somewhat Walkable

Old Central St Apartment, Newmarket: 69 out of 100 — Somewhat Walkable

My Montreal Apartment: 88 out of 100 — Very Walkable

Parents' House, Newbury NH: 12 out of 100 — Car-Dependent

Most walkable cities:

1. San Francisco

2. New York City

3. Boston

4. Chicago

WalkScore

Wednesday, March 18, 2009

THIS IS REAL. BE AFRAID. BE VERY AFRAID.

creepy intro, weird studio, viewing parties, chuck norris, 9.12 principles? this is bizarre on so many levels...

and at 2:51 all hell breaks loose.

Labels:

9.12,

bizzare,

end of the world,

fox news,

glenn beck,

weeping,

weird

Sunday, March 15, 2009

Friday, March 13, 2009

this has got to stop.

i'll agree, i've given kanye a pass for a while because he has some nice production and there seems to be a bit of merit to his work. but this. i'm not sure what's happening here...

on a side note i would like to shine up seacrest's cheek with a right hook...

cheney may have ran an "executive assasination wing"? not surprised...

this is a doozy..

Labels:

assasination wing,

dick cheney,

murderer

Stewart & Cramer - The Full Uncensored Interview

Part 1

Part 2

Part 3

Possibly one of Stewart's best interviews I've seen on this show. Now, there is something inherently unfair about the DS gag on a journalistic level; taking short clips from years ago, potentially out of context and throwing them at an unprepared guest. But there is a problem with the Media and its relationship to the markets that Stewart is addressing more directly then I've seen anywhere else on television, and I think this interview illustrates the argument he has been making for some time now.

Part 2

Part 3

Possibly one of Stewart's best interviews I've seen on this show. Now, there is something inherently unfair about the DS gag on a journalistic level; taking short clips from years ago, potentially out of context and throwing them at an unprepared guest. But there is a problem with the Media and its relationship to the markets that Stewart is addressing more directly then I've seen anywhere else on television, and I think this interview illustrates the argument he has been making for some time now.

Wednesday, March 11, 2009

For Your Health

So I've added a new gadget on the left; a list of our favorite blogs (for your health). The cool thing about it is that it also links the most recent post on that blog underneath, along with when it was posted. I started with my favorite blog, Freakonomics, along with LoA. If you have any other recommendations of blogs, or want to throw in a veto on this thing, let me know.

So I've added a new gadget on the left; a list of our favorite blogs (for your health). The cool thing about it is that it also links the most recent post on that blog underneath, along with when it was posted. I started with my favorite blog, Freakonomics, along with LoA. If you have any other recommendations of blogs, or want to throw in a veto on this thing, let me know.

Yup, That's My School

The two front page articles from yesterday's TNH;

---------------------------------------

STUDENT BODY ELECTIONS

Deadline passes, ballot remains void of candidates

For the second time in three years, the deadline for candidate petitions for student body elections passed without a single name in the running for student body president or vice-president. In an attempt to draw candidates for the top student government position, the deadline for petitions will be extended to 7 p.m. on March 25.

According to Student Senate Speaker Nicholas Wolf, petitions are only being accepted for the positions of student body president and vice-president. One petition was filed for the position of University System Student Board Representative before the Wednesday deadline, and the position won't be opened to the extended deadline. It is unclear what would happen should no candidate enter by the extended deadline. According to student senate by-laws, candidates for president must be at least second-semester sophomores and must retain their full-time undergraduate status until next April. Candidates for vice president must have been enrolled at UNH for no less than one semester.

Elections for all positions are scheduled to occur on April 22 and 23. It is unclear what will happen if no petitions are entered before that time. The new administration will take office on May 1. "Anyone who cares about the student body, who's interested about how this university works, who's interested in how they can change the community that they live in, should be interested in running for student body president and vice president," said Wolf. "It's really the best way to change UNH and to be a leader." Wolf was unsure of the reasons why no petitions had been filed. Petitions have been available since Feb. 23. Wolf said that at least 15 petitions had been taken from the office since then, but none had been returned.

LINK

Students find ways to enjoy spring break despite recession

Despite the economic downturn, students are still finding ways to travel and get away from snowy New Hampshire for spring break. Senior Angela Jones has been envisioning herself on a Jamaican Beach since early December. Jones, along with 16 of her sorority sisters from Alpha Xi Delta, will be enjoying the sunshine and clear waters for the entire break. In order to pay for the $1200 trip, Jones is spending her entire Christmas savings just to go. "I had to ask for a lot of money for Christmas," she said. "But it will all be worth it when I'm lying on a beach." Other students are traveling with parents who are paying for the vacation instead of friends so they can enjoy a warm week in destinations like Cancun and Florida. Jen Boucher, a Spanish and justice studies major, is flying down to Cancun with her mom and sister for four days. Boucher comes from a "family that loves vacations" and is taking full advantage of that fact by tagging along for a quick escape from the winter wonderland on campus.

LINK

Tuesday, March 10, 2009

Lack of Regulation or Current-Account Imbalances?

IN RECENT months many economists and policymakers, including such unlikely bedfellows as Paul Krugman, an economist and New York Times columnist, and Hank Paulson, a former American treasury secretary, have put “global imbalances”—the huge current-account surpluses run by countries like China, alongside America’s huge deficit—at the root of the financial crisis. But the IMF disagrees. It argues, in new papers released on Friday March 6th, that the “main culprit” was deficient regulation of the financial system, together with a failure of market discipline. Olivier Blanchard, the IMF's chief economist, said this week that global imbalances contributed only “indirectly” to the crisis. This may sound like buck-passing by the world’s main international macroeconomic organisation. But the distinction has important consequences for whether macroeconomic policy or more regulation of financial markets will provide the solutions to the mess.

IN RECENT months many economists and policymakers, including such unlikely bedfellows as Paul Krugman, an economist and New York Times columnist, and Hank Paulson, a former American treasury secretary, have put “global imbalances”—the huge current-account surpluses run by countries like China, alongside America’s huge deficit—at the root of the financial crisis. But the IMF disagrees. It argues, in new papers released on Friday March 6th, that the “main culprit” was deficient regulation of the financial system, together with a failure of market discipline. Olivier Blanchard, the IMF's chief economist, said this week that global imbalances contributed only “indirectly” to the crisis. This may sound like buck-passing by the world’s main international macroeconomic organisation. But the distinction has important consequences for whether macroeconomic policy or more regulation of financial markets will provide the solutions to the mess.In broad strokes, the global imbalances view of the crisis argues that a glut of money from countries with high savings rates, such as China and the oil-producing states, came flooding into America. This kept interest rates low and fuelled the credit boom and the related boom in the prices of assets, such as houses and equity, whose collapse precipitated the financial crisis. A workable long-term fix for the problems of the world economy would, therefore, involve figuring out what to do about these imbalances.But the IMF argues that imbalances could not have caused the crisis without the creative ability of financial institutions to develop new structures and instruments to cater to investors’ demand for higher yields. These instruments turned out to be more risky than they appeared. Investors, overly optimistic about continued rises in asset prices, did not look closely into the nature of the assets that they bought, preferring to rely on the analysis of credit-rating agencies which were, in some cases, also selling advice on how to game the ratings system. This “failure of market discipline”, the fund argues, played a big role in the crisis. As big a problem, according to the IMF, was that financial regulation was flawed, ineffective and too limited in scope. What it calls the “shadow banking system”—the loosely regulated but highly interconnected network of investment banks, hedge funds, mortgage originators, and the like—was not subject to the sorts of prudential regulation (capital-adequacy norms, for example) that applied to banks.

In part, the fund argues, this was because they were not thought to be systemically important, in the sense that banks were understood to be. But their being unregulated made it more attractive for banks (whose affiliates the non-banks often were) to evade capital requirements by pushing risk into these entities. In time, this network of institutions grew so large that they were indeed systemically important: in the now-familiar phrase, they were “too big” or “too interconnected” to fail. By late 2007, some estimates of the assets of the bank-like institutions in America outside the scope of existing prudential regulation, was around $10 trillion, as large as the assets of the regulated American banking system itself. Given this interpretation, it is not surprising that the IMF has thrown its weight strongly behind an enormous increase in the scale and scope of financial regulation in a series of papers leading up to the G20 meetings. Among many other proposals, it wants the shadow banking system to be subjected to the same sorts of prudential requirements that banks must follow. Sensibly, it is calling for regulation to concentrate on what an institution does, not what it is called (that is, the basis of regulation should be activities, not entities). It also wants regulators to focus more broadly on things that contribute to systemic risk (leverage, funding and interconnectedness), the significance of which was probably under-appreciated until the collapse of Lehman Brothers and the subsequent chaos. And there is much more to be done, it suggests, involving cross-border banking, disclosure requirements, indices of systemic risk and international co-operation.

Yet there is an underlying inconsistency here. The IMF’s version of “how it all happened” is a classic example of institutions gaming the regulatory system. It is impossible to anticipate all the possible ways in which regulations can be evaded. And while the wisdom of hindsight may make it appear blindingly obvious that non-bank financial institutions could become large enough to pose a risk to the entire system, clearly this was not apparent to policymakers at the time. Increasing the scope of regulation may well prevent the precise problems that led to this crisis from recurring in the same way, but nothing stops financiers from finding ways to evade the plethora of regulations that the fund is proposing. It is hard to shoot a moving target. And what about those pesky imbalances? The IMF’s view, broadly speaking, is that without excessive risk-taking by financial institutions, which was aided by the absence of regulation, imbalances would not by themselves have caused the meltdown. But equally, without the flood of money seeking returns, the risky financial instruments that the IMF is blaming for increasing systemic risk may not have grown and posed the risk that they did. Some blame the IMF’s policies during the Asian crisis for spurring countries in the region to build up enormous reserves. That may offer part of the explanation for why the Fund has come down so strongly on one side of the debate.

The Economist

------------------------------------------------------------------------------------------------

This is a good article on the Current-Account imbalances around the world and their effect on the economic meltdown. The Economist assesses the debate of what went wrong pretty accurately in my opinion, with both clearly contributing to the crisis.

Now This is a Dirty Foul

With Portland blowing out the Lakers by 30 points, Trevor Ariza clotheslines Rudy F from behind. Rudy was later taken off on a stretcher, Ariza got a flagrant 2.

Monday, March 9, 2009

Film Directors Doing Comedy Routines

Featuring Wes Anderson, Michael Moore and Quentine Tarantino...

This Would Make A Soccer Player Blush

AK47 with perhaps the worst flop I've ever seen, a few months ago against Chris.

Big Baby v Varejao

I know this is old news, but I hadn't watched it since it was live at the bar, and just now realized how much of a flop this was. Varejao lands relatively softly, immediately grabs his face like Baby just broke his nose, and then upon noticing there was a bit of a tussle going on jumps strait up, perfectly fine.

UPDATE: The NBA yesterday reduced Davis’ Flagrant 2 foul Friday night on Cleveland’s Anderson Verajao to Flagrant 1 status. But with that move, the league didn’t tell Rivers anything he didn’t already know. “I could have done that live,” said Rivers. “That wasn’t very hard to do. It was probably an overreaction because of the importance of the game. The game was getting a little chippy, and they felt they had to keep it under control. But when they said Flagrant 2 you knew they were going to reverse it.” Well, not quite. Though Davis was spared a fine or further suspension, there was no way to take back his ejection from the Cavaliers game.

LINK

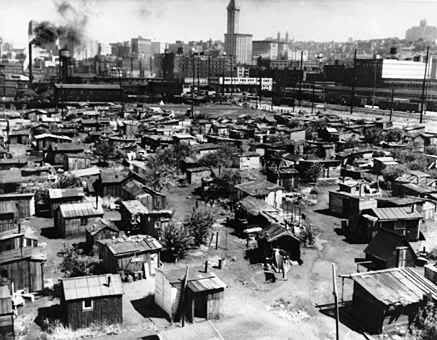

The Recession Generation: Future Squares?

IN 1951, Time magazine set out to paint a portrait of the nation’s youth, those born into the Great Depression. It doomed them as the Silent Generation, and a generally drab lot: cautious and resigned, uninterested in striking out in new directions or shaping the great issues of the day — the outwardly efficient types whose inner agonies the novel “Revolutionary Road” would dissect a decade later. “Youth’s ambitions have shrunk,” the magazine declared. “Few youngsters today want to mine diamonds in South Africa, ranch in Paraguay, climb Mount Everest, find a cure for cancer, sail around the world or build an industrial empire. Some would like to own a small, independent business, but most want a good job with a big firm, and with it, a kind of suburban idyll.” The young soldier “lacks flame,” students were “docile notetakers.” And the young writer’s flair “sometimes turns out to be nothing more than a byproduct of his neuroses.” (This even before Philip Roth, born 1933, had published a novel.)

“The best thing that can be said for American youth, in or out of uniform, is that it has learned that it must try to make the best of a bad and difficult job, whether that job is life, war, or both,” Time concluded. “The generation which has been called the oldest young generation in the world has achieved a certain maturity.” Today we are in a recession the depth and duration of which are unknown; Friday’s job loss figures were just the latest suggestion that it could well be prolonged and profound rather than shorter and shallower. So what of the youth shaped by what some are already calling the Great Recession? Will a publication looking back from 2030 damn them with such faint praise? Will they marry younger, be satisfied with stable but less exciting jobs? Will their children mock them for reusing tea bags and counting pennies as if this paycheck were the last? At the very least, they will reckon with tremendous instability, just as their Depression forebears did.

“The ’30s challenged the whole idea of the American dream, the idea of open economic possibilities,” said Morris Dickstein, an English professor at the Graduate Center of the City University of New York, whose cultural history of the Depression will be published in September. “The version you get of that today is the loss of confidence on the part of both parent and children that life in the next generation will inevitably be better.” How today’s young will be affected 10, 20 or 40 years on will depend on many things — the children of the Depression were shaped as much by the war that followed. The recession generation will include those born into it, at the youngest end, and those emerging out of college and high school into a jobless marketplace, at the oldest. If history is any guide, what will matter most is where they are on the continuum.

-NYTimes

Read Full Article

--------------------------------------------------------------------------------

A good interesting read, obviously very speculative, but seems to suggest that those that are young now will be most affected. Some of the analysis is scary though; some suggest that those graduating college in the (smaller) recessionary period of the early 1980s were held back by a decade...

“The best thing that can be said for American youth, in or out of uniform, is that it has learned that it must try to make the best of a bad and difficult job, whether that job is life, war, or both,” Time concluded. “The generation which has been called the oldest young generation in the world has achieved a certain maturity.” Today we are in a recession the depth and duration of which are unknown; Friday’s job loss figures were just the latest suggestion that it could well be prolonged and profound rather than shorter and shallower. So what of the youth shaped by what some are already calling the Great Recession? Will a publication looking back from 2030 damn them with such faint praise? Will they marry younger, be satisfied with stable but less exciting jobs? Will their children mock them for reusing tea bags and counting pennies as if this paycheck were the last? At the very least, they will reckon with tremendous instability, just as their Depression forebears did.

“The ’30s challenged the whole idea of the American dream, the idea of open economic possibilities,” said Morris Dickstein, an English professor at the Graduate Center of the City University of New York, whose cultural history of the Depression will be published in September. “The version you get of that today is the loss of confidence on the part of both parent and children that life in the next generation will inevitably be better.” How today’s young will be affected 10, 20 or 40 years on will depend on many things — the children of the Depression were shaped as much by the war that followed. The recession generation will include those born into it, at the youngest end, and those emerging out of college and high school into a jobless marketplace, at the oldest. If history is any guide, what will matter most is where they are on the continuum.

-NYTimes

Read Full Article

--------------------------------------------------------------------------------

A good interesting read, obviously very speculative, but seems to suggest that those that are young now will be most affected. Some of the analysis is scary though; some suggest that those graduating college in the (smaller) recessionary period of the early 1980s were held back by a decade...

Time for Practice

The Newmarket BBall season officially started today, and I know y'all are a little rusty. You know what that means. Time for practice. Not the game. Practice. I'm talkin about Practice. Not a game, not a game, not a game. We're talkin about practice. Practice? Practice.

Practice.

Practice.

Sunday, March 8, 2009

You = Losers, CNBC = Winners

The Daily Show With Jon StewartM - Th 11p / 10c

This is America, we don't pay for losers' houses. Should've watched CNBC dummy.

Thursday, March 5, 2009

Cheaper than a cup of coffee...

Today Citi Group Inc. became a penny stock before closing slightly above a dollar. As I read this news, some bizarre mix of capitalist/Jewish impulsiveness took over me, and I bought 500 shares of it before the market closed. For richer or poorer I suppose, but I've wasted so much fucking money in my life I decided even if all goes wrong it was worth the risk. Any opinions from the analysts?

How to Stop the Drug Wars

A HUNDRED years ago a group of foreign diplomats gathered in Shanghai for the first-ever international effort to ban trade in a narcotic drug. On February 26th 1909 they agreed to set up the International Opium Commission—just a few decades after Britain had fought a war with China to assert its right to peddle the stuff. Many other bans of mood-altering drugs have followed. In 1998 the UN General Assembly committed member countries to achieving a “drug-free world” and to “eliminating or significantly reducing” the production of opium, cocaine and cannabis by 2008.

That is the kind of promise politicians love to make. It assuages the sense of moral panic that has been the handmaiden of prohibition for a century. It is intended to reassure the parents of teenagers across the world. Yet it is a hugely irresponsible promise, because it cannot be fulfilled.

Next week ministers from around the world gather in Vienna to set international drug policy for the next decade. Like first-world-war generals, many will claim that all that is needed is more of the same. In fact the war on drugs has been a disaster, creating failed states in the developing world even as addiction has flourished in the rich world. By any sensible measure, this 100-year struggle has been illiberal, murderous and pointless. That is why The Economist continues to believe that the least bad policy is to legalise drugs.

“Least bad” does not mean good. Legalisation, though clearly better for producer countries, would bring (different) risks to consumer countries. As we outline below, many vulnerable drug-takers would suffer. But in our view, more would gain.

Read The Full Article

-----------------------------------------------------------------------------------

There really shouldn't be anything new in this article to anyone reading this blog; the horrible, miserable failure that the drug war has been along with the basic political right of any individual to do what they want provided it harms no one else should have led anyone with half a brain to push for legalization years ago. However, while this is not the first time the Economist has made the case for legalization, putting it on the cover of their magazine at this given time seems to fall in line with the general trend lately of mainstream media coverage being in favor, or at least honestly open about the drug war/legalization debate. Let's hope this leads to significant legislation finally being passed in this country that begins to end the epic fuck-up the drug war is.

Wednesday, March 4, 2009

Drink Up Danny

Tuesday, March 3, 2009

random rookie video edit

word on the street is filming for the toast house original starts this weekend.

new hampshire stand up

A strange looking cat has been causing a stir at a veterinary hospital in America.

The cat's name is Ugly Bat Boy and he is bald apart from a furry chest.

Dr. Stephen Bassett was given the cat by a client and says Ugly is happy with the attention he attracts at his surgery in Exeter, New Hampshire, in the USA.

Hospital staff say the curious cat can scare and mesmerise people.

click here! for the video..

this was one of the top read stories on the bbc world news...

The cat's name is Ugly Bat Boy and he is bald apart from a furry chest.

Dr. Stephen Bassett was given the cat by a client and says Ugly is happy with the attention he attracts at his surgery in Exeter, New Hampshire, in the USA.

Hospital staff say the curious cat can scare and mesmerise people.

click here! for the video..

this was one of the top read stories on the bbc world news...

Monday, March 2, 2009

NBA: The No Benjamins Association

A Great Article From The Sports Guy

Its too long and varied to really sum up by pasting a paragraph or two, but just trust me and read it. The SG discusses the effect the money drain is having on the nba, from a lack of dominate franchises, no major trades, setting the stage for a lock out in 2011, the collapse and or moving of small market franchises, and more. While he makes the argument that the NBA will fair better than the MLB and certainly the NHL (he cites one anonymous source within the NHL that claims up to 15 NHL Franchisees could fold in the next few years), he nevertheless makes the case that dark times are ahead for the league.

Its too long and varied to really sum up by pasting a paragraph or two, but just trust me and read it. The SG discusses the effect the money drain is having on the nba, from a lack of dominate franchises, no major trades, setting the stage for a lock out in 2011, the collapse and or moving of small market franchises, and more. While he makes the argument that the NBA will fair better than the MLB and certainly the NHL (he cites one anonymous source within the NHL that claims up to 15 NHL Franchisees could fold in the next few years), he nevertheless makes the case that dark times are ahead for the league.

Sunday, March 1, 2009

emcee macho man randy savage.

here's the macho man dedicating one for kurt hennig, aka mr. perfect:

i'm pretty sure this is a collabo track with dmx...or someone who sounds a lot like dmx...

don't sleep...

i'm pretty sure this is a collabo track with dmx...or someone who sounds a lot like dmx...

don't sleep...

Subscribe to:

Posts (Atom)